The European Union is on the prowl for lithium and rare earth elements to help power the next phase of the digital and ecological revolution. Aspirations for fame, however, must contend with the Nimby effect.

At least 10 years late, Europe's battle to gain mining independence has finally started. Going across France and Italy on route to Sweden. Ursula von der Leyen, president of the European Commission, said last month that lithium and rare earths will soon eclipse the value of oil and gas. There will be a fivefold rise in the need for rare earths by that time. However, the EU is now very reliant on foreign nations for these resources, which are vital for the ecological transition and to power the batteries of electric vehicles. And it runs the danger of being there for a considerable period of time, as even if the fields are present.

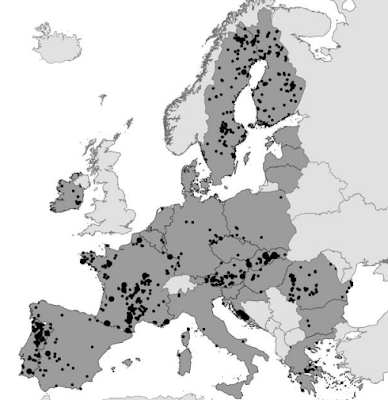

Critical raw materials in Europe

The annual cost of Europe's raw materials imports is 31 billion euros. This hasn't been an issue until now. However, in recent years, the alarm bell has rung in Brussels, particularly in light of the growing energy crisis that is hastening the green transition. The European Commission released a statement in September 2020 titled "Resilience of vital raw materials: charting a path towards enhanced safety and sustainability," which has increased efforts at EU level to identify and encourage initiatives to lessen the bloc's reliance on foreign sources.

The Brussels aim zeroed particularly on 30 "essential" raw resources for the development of European manufacturing. Only three are harvested in significant amounts inside the EU at now, while as many as seventeen depend entirely (or almost entirely) on nations outside the EU for their supply. These include indium, used in semiconductors, and cobalt, used in jet turbines; lithium, used in vehicle batteries; with the biggest domestic source of lithium being the north of Portugal. In terms of rare earths, which are becoming more important for the electrification of transportation, we rely on China for more than 90% of our supply. A connection that was likened to the one with Russia over gas at the previous EU summit, raising concerns about the potential for economic and geopolitical instability.

The map of subsoil in Europe

To solve this, Europe has suggested three approaches. The first goes via mining sovereignty. According to the estimations of the Research Center of the EU Commission, "the value of unexploited European mineral resources at a depth of 500-1,000 meters is estimated at roughly 100 billion euros". A map attached to the 2020 communication shows the potential of EU countries for critical raw materials: there is the aforementioned Portugal, but also France, whose Geological and Mining Research Office in 2018 drew up a map of the riches of the transalpine subsoil which made President Emmanuel Macron's eyes shine. High concentrations of important raw minerals are also observed in Austria, the Czech Republic, Romania, Sweden, Finland and Spain. Deposits, although to a considerably lower level.

Lithium mines in Europe

But it is one thing to see the potential, another to use it. The case of lithium is emblematic: in 2019 the Commission "identified with the Member States 10 potential mining projects for lithium which, if developed, could allow the EU to shift from 1 to 30% of world production by 2030" , explained the EU commissioner Maros Sefcovic, whose estimates, however, have been revised downwards. Of these initiatives, one was unveiled this week in France: the transalpine business Imerys announced the exploitation of the Echassières field in the middle of the country: "We will power 700 thousand electric vehicles a year", forecasts the company. But the extraction did not commence until 2028.

In Finland, however, lithium extraction is planned to begin as early as 2024 at a minor mining location 600 kilometers north of Helsinky. In Portugal, a resource of 270,000 tons of lithium has just been found, the Mina do Barroso, in the north east of the nation. Other important projects include the European Metals Cinovec site in the Czech Republic, the European Lithium Wolfsberg project in Austria, which might start operations around 2023, the Zinnwald project in Germany, and the San Jose project in Spain. In Italy, as revealed by an investigationdi RomaToday, the Australian firm Vulcan Resources has secured the exploration permission for an area a few kilometers from Rome, in the region around the Cesano 1 well, where there might be potential lithium possibilities.

All these initiatives, however, must also take into consideration the Nimby factor, that is the opposition of the local populace. Extracting lithium and rare earths is very polluting, as the European Commission itself has stated. In Portugal, the potential Mina do Barroso is already the focus of violent protests that are impeding its progress. In Sweden, the extraction activity in one of the largest rare earth deposits in the EU, that of Norra Karr, has stopped due to opposition from residents and agricultural entrepreneurs: the proposed site is located near a Natura area 2000, i.e. protected by EU legislation, and above Vattern, the deepest and second largest lake in Sweden, which supplies 250,000 people with fresh water. These are not unique cases: everywhere new mining ventures appear, demonstrations are aroused.

Aware of the time required to start the mines, and also of the Nimby factor, the European Commission is also exploring two alternative options to make the supply of essential raw materials more secure. One goes from the Western Balkans, through Australia and Chile, up to Africa and the Arctic: Brussels is examining ways to incorporate the question of the supply of raw materials in trade agreements with Australia and Chile, which produce enormous amounts of lithium. The free trade agreement with Canada, already implemented in an experimental phase, has also been highlighted by German companies as a benefit for the supply of nickel and rare earths.

Then there is Africa, with huge stocks of vital raw minerals such as cobalt and platinum metals. In the Arctic, the EUhe would even set aside his ambitions on gas and oil in order to acquire the riches of the subsurface and take them from third-party rivals. But a speedier approach to collect lithium and rare earths is surely to go to the neighbors, from Serbia to Albania , where major reserves have been located. The reality is that even in the Western Balkans, but especially in the remote Arctic, there is no lack of opposition from local residents to hamper mining plans.

And so we get to the final avenue that the EU is attempting to follow in order not to run out of raw materials: the circular economy. This is what, for example, the European Parliament called for in a recent resolution: the recovery and reuse of important raw materials "is vital given the large presence" of these "in electrical and electronic equipment". The Commission and Member States "should increase their efforts to appropriately collect and recycle end-of-life items" containing key raw materials, "instead of keeping them in homes and landfills, or incinerating them". According to MEPs, "stricter restrictions on EU exports of critical waste products are required" containing these elements.

Source: TODAY.IT